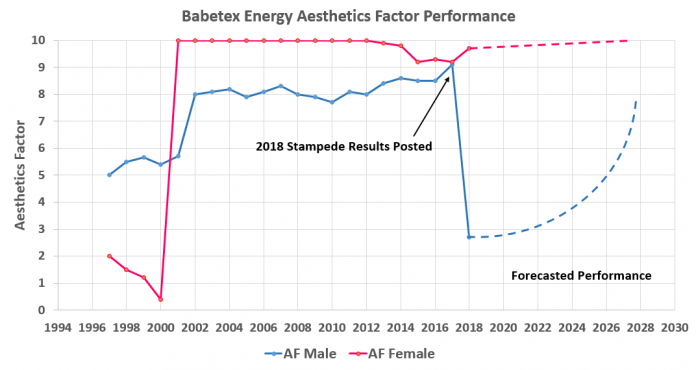

- Babetex Energy downgraded despite strong Q3 results and increased production guidance.

- Aesthetics Factor metric for both men and women down by an average of 3 points, year-over-year.

TORONTO, Ontario – After posting very poor 2018 Stampede week results and missing the mark on Stephen Ave expectations, Babetex Energy (BBTX.TO) has been downgraded to Sosotex Energy by analysts at Stankcore and Pours.

The intermediate Calgary-based oil and gas producer posted a net aesthetics factor (AF) loss in the third quarter of 2018 and plans to focus significant resources on improving talent acquisition within both internal hiring practices and also better vetting the AF for vendors who are invited to its annual Stampede party.

“Our AF surged in Q4 2002 shortly after we hired the former talent director at Joey Tomatoes as our VP of Talent Acquisition. But despite Mr. Howie Feltersnatch leaving Babetex 6 weeks before the Calgary Stampede, I never in my wildest dreams anticipated such a precipitous drop in our average AF by Friday, July 13th when we hosted our party. This is my responsibility and I promise investors that I will turn things around.” – Hugh G. Reckshun, Babetex President & CEO

The company said it lost nearly 35 million Stud Cred points, or 32.4 cents a share, for the 10 days ending with July 15th. But it was pleased to announce that it gained just over 3.4 million Babe Cred points, or 6.9 cents a share, over the same period.

Disappointing results on the streets

The company missed Stephen Avenue expectations. Street-side analysts from Groomberg expected Babetex to post a combined Stud/Babe Cred loss of only 420,000 points.

“I’ve been following Babetex for quite a while now, and since its big turnaround in late 2015 I’ve been seeing progressively more good looking male staff in its downtown [Calgary] head office and in the field, but their Stampede Party is where they typically performed the best. But this year’s party was very disappointing; I regrettably bumped into a few uglies who I’m surprised made it past their hiring practices… and now I think it’s time for me to sell.” – Anita Goodrod, Babetex investor looking to reduce her position in the company

2012 hedging did not pay off for Babetex

Babetex Energy Corp’s loss includes an 80.6 million Cred points loss related to its hedging activities. The 31 interns and summer students that the company hired at an average aesthetics factor of 8.5/10 in 2016 started full-time work this year with a median 5.6/10 rating with a 3 standard deviation spread.

According to unofficial reports on the street, one intern, Willie B. Hardagain, was not hired on full-time after an unfortunate incident resulting in him falling off the ugly tree and hitting every single branch on the way down.

The weather played a big role in the results

CEO Hugh G. Reckshun also blamed cooler than expected temperatures and some rain during his Stampede party that caused employees and invited guests to don more clothing than normally acceptable for a typical Stampede event.

Also blamed for the downgrade to Sosotex Energy are the staff members who came across in the acquisition of Moosimin, Saskatchewan-based Swampdonkey Resources in early 2018. He blamed a significant portion of his company’s declining AF on poor performance in the looks department from that purchase.

“If Sosotex’s AF performance doesn’t improve by Q4 2018, I will strongly consider further downgrading it to Whoatex Energy, but for now I trust Mr. Reckshun’s plans and I urge investors to hold,” analyst Dick Fitzenwell, with Gloomberg.